A 40-Year Legacy Explains It All

When a European designer brand wants to mass-produce new leather handbags, when a Southeast Asian startup needs a small batch of canvas bags for testing, or when a U.S. e-commerce platform plans to launch its own leather goods line—their eyes often turn to China. “Choosing a Chinese factory” is no longer just about cost; it’s the unspoken “best choice” in the global leather goods industry. From sourcing materials to delivering finished products, from craftsmanship precision to flexible production, China’s strength in leather goods manufacturing is no accident. It’s the result of 40 years of industrial accumulation and full-chain capabilities.

1. From OEM Beginnings to Industry Leadership: The Evolution of China’s Leather Goods Sector

The strength of China’s leather goods manufacturing lies in decades of “dancing” with global brands. In the 1980s, as reform and opening-up took hold in the Pearl River Delta and Yangtze River Delta, areas like Huadu in Guangdong and Haining in Zhejiang were among the first to receive international orders. Back then, Chinese factories were more like “sewing workshops,” where workers operated sewing machines to handle basic stitching for Western brands. High-end craftsmanship and core technologies remained firmly in foreign hands. But this “starting point” allowed Chinese factories to first grasp global standards: what counts as “qualified stitch density,” how to treat leather edges to prevent cracking, and what level of corrosion resistance hardware accessories need.

By the 1990s, as orders surged, Chinese factories shifted from “passive execution” to “active learning.” Small workshop owners in Shiling Town, Guangzhou, carried samples to the Canton Fair, secretly studying the craftsmanship of luxury brands. Leather merchants in Haining traveled to Italy, bringing back imported equipment and tanning techniques. By the 2000s, China’s leather goods industry had made a “triple jump”: from simple OEM assembly to mastering core techniques like edge painting, embossing, and vintage finishing, and finally to offering value-added services such as design optimization and material advice.

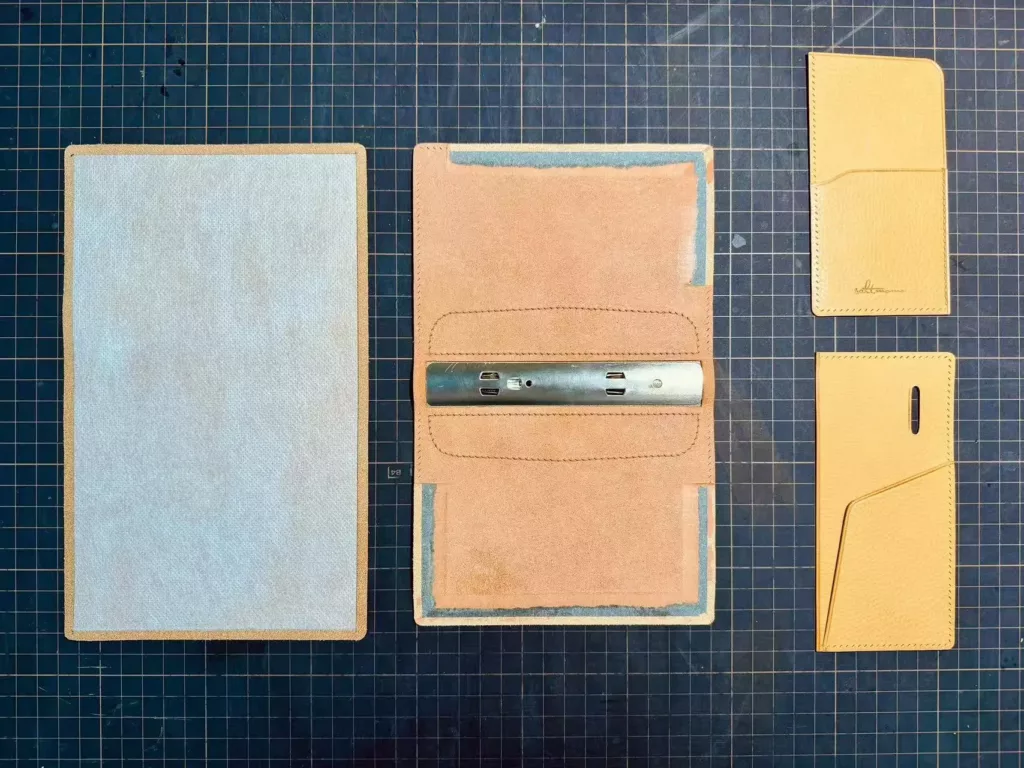

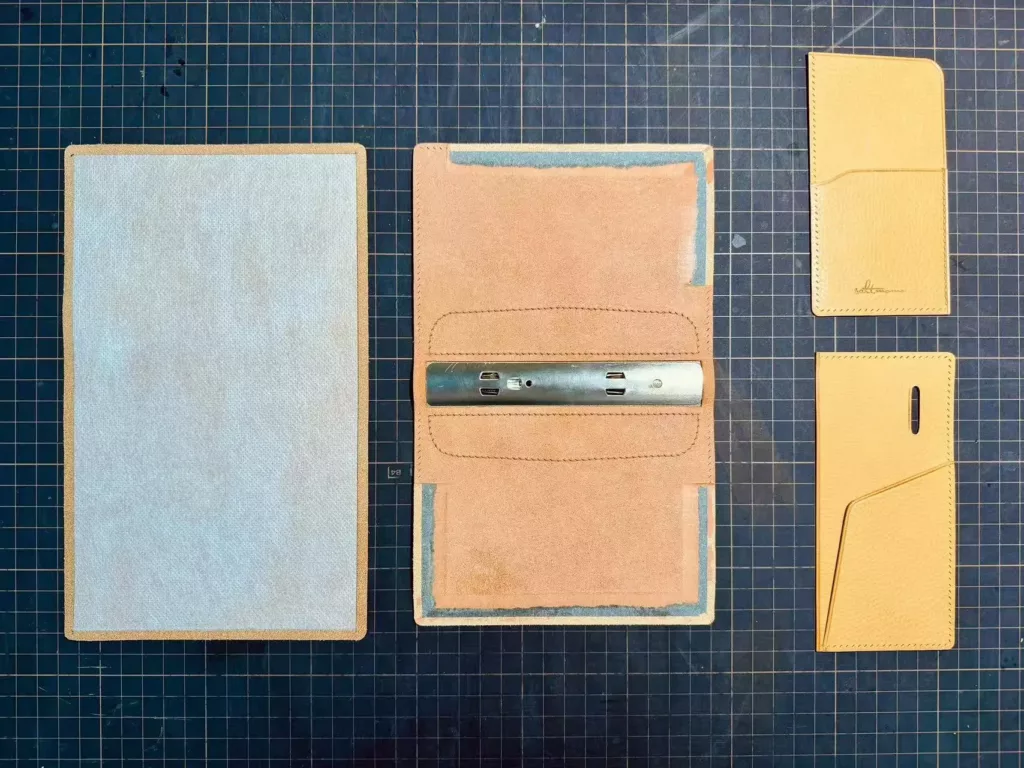

Today, Shiling Town has transformed from a “cluster of family workshops” into the world’s largest leather goods production base, with an annual output value exceeding 100 billion yuan. It can gather all materials and accessories needed for a handbag within 24 hours. A veteran craftsman at a local factory still remembers that when producing a classic wallet for a French luxury brand in 2008, the “edge painting” process alone went through 17 adjustments—from the concentration of paint and drying temperature to the number of polishing steps—until it met the standard of “no marks after repeated scratching with nails.” This pursuit of craftsmanship perfection is a reflection of decades of accumulation.

In contrast, emerging manufacturing regions in Southeast Asia, while attracting orders with low costs, remain stuck in “processing with supplied materials.” A Vietnamese leather factory owner once admitted: “We can sew simple canvas bags, but when it comes to hand-stitched leather bags, the qualification rate is only 60%. Workers don’t understand the stress characteristics of different leathers—this isn’t something that can be fixed with three months of training; it takes over a decade of experience.”

2. Seamless Supply Chains: Full Control from Materials to Finished Products

The core challenge in leather goods production is never just “sewing leather together,” but “efficiently and stably completing every step from raw materials to finished products.” In this regard, China’s supply chain advantages are almost unrivaled.

First is the “variety and adaptability” of raw materials. Whether it’s Italian imported top-grain cowhide, Spanish sheepskin, domestically developed eco-friendly recycled leather, or wear-resistant canvas, China’s leather materials market can “supply on demand.” Guangzhou’s Sanyuanli Leather City gathers thousands of material suppliers, offering everything from “0.5mm ultra-thin leather” to “3mm thick, wear-resistant leather.” They can even customize special textures for brands—such as a “waterproof and stain-resistant cowhide” developed for an outdoor brand, which undergoes 13 special treatments to remain flexible at -20°C.

More importantly, there’s the “cluster effect” of supporting industries. Producing leather goods involves dozens of steps: cutting, sewing, hardware accessories (zippers, buckles, rivets), printing, gold stamping, and packaging. China’s industrial clusters have long formed a “1-hour support circle.” In Pinghu’s luggage industry cluster in Zhejiang, if a factory needs to add a metal logo to a bag, there are 5 hardware factories within 3 kilometers, capable of producing samples the same day. For digital printing, neighboring factories with imported equipment can achieve “1200dpi pattern precision.” This efficiency from clustering is hard to replicate elsewhere.

Southeast Asian factories feel this deeply. A mid-sized Vietnamese leather factory once took an order from a European brand but couldn’t find the required “matte zippers” locally. They had to source them from Yiwu, China, losing 12 days in transportation and paying an extra 30% in logistics costs. “Our workers’ wages are indeed lower than in China, but the hidden costs of materials and accessories are so high that it’s actually less cost-effective,” the factory manager lamented, highlighting the frustration of supply chain shortcomings.

3. Craftsmanship Precision: The “Chinese Standard” in Details

The value of leather goods often lies in details invisible to consumers—whether stitches are even, edge paint is smooth, and leather seams are neat. This ability to control details is the “hard power” of Chinese factories.

Skilled workers in China’s leather goods industry are like “artists with their fingertips.” In a workshop in Guangzhou, a sewing master can evenly stitch 9 needles in 1 centimeter of leather, with a needle spacing error of no more than 0.1mm. An edge-painting master uses a process of “three polishes and two coats of paint” to give bag edges a “mirror-like smoothness,” which won’t crack even when folded 180 degrees. These skills aren’t innate; they come from daily accumulation. A senior edge-painting supervisor with 23 years of experience can judge the paint concentration by feel: “Too thin, it drips; too thick, it wrinkles. The error can’t exceed 5%.”

This precision is backed by standardized quality control systems. Chinese factories generally have full-process quality checks from material inspection to finished product delivery: leather is checked for thickness and defects before storage; hardware undergoes salt spray testing (to ensure it doesn’t rust for 500 hours); finished products pass pull tests (stitches must withstand 5kg of force) and friction tests (no obvious fading after 300 rubs). A factory producing for a Light luxury brand even uses 3D scanning technology to check if a bag’s curvature matches the design, with errors controlled within 0.3mm.

In comparison, Southeast Asian factories still struggle with craftsmanship consistency. Industry data shows that for similar leather bag orders, Chinese factories have an average qualification rate of 92%, while Southeast Asian factories range from 75% to 80%. A cross-border e-commerce platform once tested: when comparing Chinese and Southeast Asian-made canvas bags, the Chinese one remained stitched firmly after 100 swing tests with a 10kg load, while the Southeast Asian one had loose stitching in 3 places. “Consumers might not check intentionally, but they’ll notice the difference over time,” said the platform’s purchasing manager.

4. Balancing Cost and Efficiency: Not Just “Cheap,” but “Cost-Effective”

When people think of Chinese manufacturing, “low cost” often comes to mind. But the truth is, Chinese factories’ advantage is never just being “the cheapest,” but “the most cost-effective.” This value comes from balancing visible and hidden costs.

In terms of visible costs, China’s “per-unit product cost” is actually more advantageous. While Chinese workers’ hourly wages are 1.5 to 2 times those in Southeast Asia, their productivity is also higher—skilled workers can finish 30 leather bags a day, compared to an average of 15 to 20 for Southeast Asian workers. This makes China’s “per-unit labor cost” lower. For a basic leather wallet, Chinese factories’ labor cost is about 18 yuan per unit, while Southeast Asian factories, despite lower hourly wages, end up with costs of 15 to 17 yuan due to inefficiency—a tiny difference. More importantly, Chinese factories have a rework rate of only 3% to 5%, compared to 10% to 15% in Southeast Asia, where secondary processing costs widen the gap further.

The advantage in hidden costs is even clearer. China’s logistics efficiency lets brands “save time, which saves money”: materials take no more than 3 days to reach factories from domestic suppliers, and finished products can reach major Western ports within 2 weeks from Shanghai or Guangzhou. In Southeast Asia, just transporting materials can take 1 to 2 weeks, with delays common during rainy seasons. Additionally, language-free communication and quick after-sales responses (such as solving problems within 48 hours) help brands avoid “losses from misunderstandings.”

A U.S. startup’s experience is telling: they tried manufacturing in Bangladesh, where unit costs were 10% lower. But due to communication gaps (misunderstandings in design details), the first 2,000 bags had to be reworked. They missed the Christmas rush and paid extra rework fees, making the final cost 1.5 times that of Chinese manufacturing. “Now we stick to Chinese factories, not because they’re cheap, but because they’re ‘reliable’—delivering on time and to standard is more important than anything,” the brand founder said.

5. Irreplaceable “Flexible Production”: Small Batches and Mass Orders Alike

The global leather goods market is changing: consumers crave more personalization, and brands need “small batches, multiple styles” to test the market quickly. This demands “flexible production capabilities,” where Chinese factories excel.

Chinese factories handle orders ranging from “dozens to hundreds of thousands” with ease. A factory producing for an internet-famous brand once achieved “3-day sampling and 7-day mass production of 500 units”: the designer confirmed the blueprint in the morning, the factory arranged cutting in the afternoon, worked overtime to make samples at night, and shipped samples to the client on day 3. After approval, 500 units were produced within 7 days. This “small-batch, fast-turnaround” ability comes from flexible production line scheduling—skilled workers switch styles quickly, and digital cutting machines handle different sizes in an hour. In contrast, Southeast Asian factories rely on fixed assembly lines, with small orders taking over a month and costing 30% more.

For large orders, Chinese factories also deliver. A Guangzhou factory with 20 production lines produces 20,000 backpacks a day at peak, ensuring “uniform stitching and hardware placement on every bag.” This flexibility—handling both delicate small batches and massive orders—makes Chinese factories the “versatile partner” for all brands.

Conclusion: More Than Manufacturing, a “Partner”

From initial “OEM production” to today’s “full-chain empowerment,” Chinese leather goods factories have quietly transformed. They’re no longer just “executors” but “partners” offering material advice, craftsmanship optimization, and cost control.

For luxury brands, they replicate the most complex traditional techniques. For startups, they turn blueprints into producible products and suggest “using recycled leather instead of genuine leather to cut costs.” For fast-fashion brands, they keep up with “weekly new releases,” ensuring “delivery within 15 days of ordering.” This “customized service” ability stems from 40 years of industrial heritage.

As global leather goods brands balance cost, quality, and efficiency, Chinese factories provide a clear answer: here, there’s not just a mature supply chain and exquisite craftsmanship, but a deep understanding of the leather goods industry. Choosing Chinese manufacturing is, in essence, choosing to “avoid detours”—and that’s perhaps the ultimate reason why global brands prefer China.